For example, rent, utility, and supplies are necessary for the manufacturing process, and these expenses are charged as production overheads that are ultimately allocated to inventory. The conversion of raw inventory into finished goods may result in incurring production-related expenses. On the other hand, finished goods are purchased and recorded if the business model is based on trading (buy and sales). However, if the business model is processing and sale, the material purchase is recorded. It depends on the nature of the business whether to record inventory as raw material or merchandise inventory. Particulars Debit Credit Inventory Account (Finished goods) XXX Cash/Accounts Payable XXX Now, if you haven’t paid your suppliers immediately and agreed to terms that payment will be made after a few days, we shall credit Accounts payable instead of cash.įurther, the following entry will be passed if your business deals in merchandise to buy finished goods and resell them to the customer by adding profit margin. Particulars Debit Credit Raw Material Inventory XXX Cash XXX If we have paid our suppliers in cash, the cash account is credited to show that cash has been used to finance raw material inventory. We shall debit the raw material and credit either cash or accounts payable to record the inventory purchases. Fixed Asset Exchange: All you need to know! Accounting for Inventory Purchase of inventory The combined figure of these days constitutes an inventory cycle. The inventory cycle is usually calculated by estimating the number of days.įor instance, it may take a week to order the goods, 3 days may be used to process raw material, and two days may be required to pack finished goods and deliver to customers. The last stage involves the packaging and delivery of finished goods to customers.

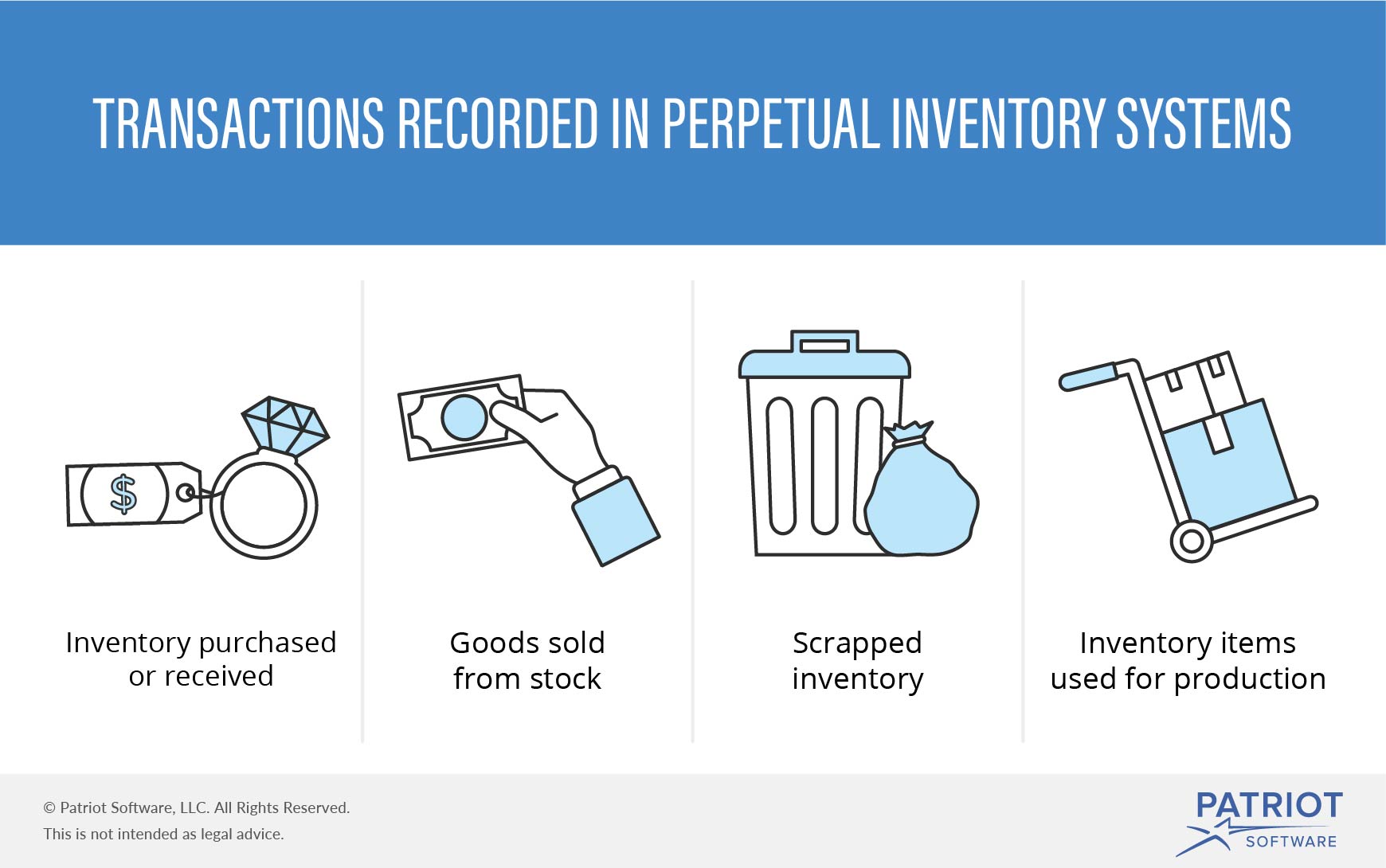

The inventory purchased is then processed (known as Work in progress) to produce finished goods. In the first stage, inventory is ordered to meet the demand of business operations. The inventory cycle is comprised of three following stages. On the other hand, a perpetual inventory system is a much-detailed way of recording the transaction and is suitable for higher inventory levels businesses. The periodic inventory system is better for those businesses that maintain less inventory. For example, entries are made to record purchases, sales, and spoilage/obsolescence, etc.įurther, two inventory accounting systems record the journal entries for inventories, i.e., periodic and perpetual. Various kinds of journal entries are made to record the inventory transactions based on the type of circumstance. Inventory transactions are journalized to keep track of inventory movements.

#ACCOUNTING INVENTORY DEFINITION HOW TO#

How to record a journal entry for inventory? In this article, we shall explain how to record journal entries for inventories under different scenarios. To record journal entries for inventories, you must have a basic understanding of the double-entry methods. Learning about different accounting entries is necessary to balance the financial figures to keep track of business inventories. So, there is a need to account for inventories properly via recording journal entries of purchasing, processing, and selling. Knowing how much inventory you have at your business premises and what level should be maintained mitigates the risk of an out-of-stock situation. Inventory management is one of the important areas to run and manage your business effectively.

0 kommentar(er)

0 kommentar(er)